Since 1996, The Hartman Group has been charting the consumer-driven organic and natural marketplace – find out where the market is going next in new research and an upcoming webinar.

Going into a third year of pandemic-driven disruption, change has certainly been in the air. More so than ever before, evolving consumer attitudes and behavior (including beliefs relating to personal empowerment, resiliency, connectivity and a desire for systemic change) have been playing into increased demand for organic foods and beverages. One piece of evidence lies in market information from the Organic Trade Association (OTA) which estimated total organic food and beverage sales of $56 billion in 2020, with a growth rate of over 12%. Per OTA, organic foods and beverages now represent approximately 6% of all U.S. food and beverage sales.

Other evidence lies in Hartman Group organic research which extends back to 1996 and is currently undergoing a bi-annual update in a soon to be released report Organic & Natural 2022. We find that organic remains one of the most widely recognized food and beverage certifications, serving as a guarantee of quality, purity and healthfulness. While not always sure of the specific requirements, consumers see organic products as higher quality and healthier for them.

Of great interest, and further evidence of the ongoing expansion of the organic market, is an increase among consumers already involved with organics buying such products more frequently and across a wider number of categories. As found in our Organic and Beyond 2020 report, Figure 1 highlights how from 2010 to 2020, consumer purchase of organics expanded in terms of daily/weekly usage— In 2020 a full 82% of consumers say they used organic foods and beverages in the past three months (compared to 75% in 2010), with 29% reporting weekly or daily usage (compared to 23% in 2010).

Figure 1: Organic Food and Beverage Usage Frequency 2010 – 2020

Source: Organic and Beyond 2020 report, The Hartman Group Inc.

Figure 1 also illustrates how we are entering a new, mature stage in the organic market, as the breakneck pace of growth over the past decade has slowed. The expansion of organics across categories and channels is reflected in the steady number of consumers who say they use organic foods and beverages weekly or daily. Usage varies, however, according to consumer age and where they fall in terms of their overall involvement with the World of Organic, a world model in which “Core” organic consumers are the most intensely involved, and those in the “Periphery,” least involved. Organic daily and weekly usage numbers rise substantially among younger consumers with 37% of Millennials reporting they use daily or weekly compared to just 19% of Baby Boomers.

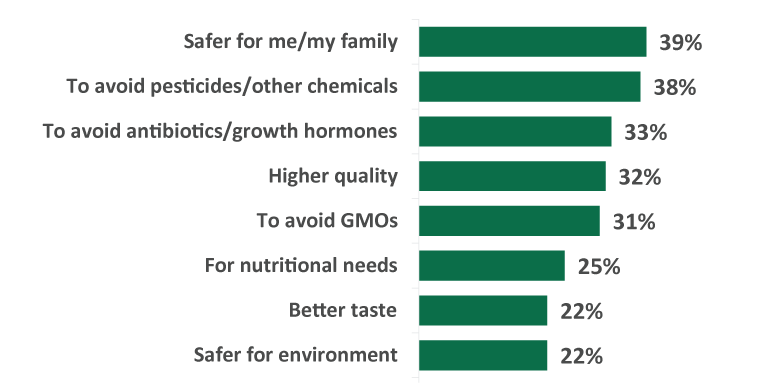

While the pandemic has spurred interest in organic, many of the motivations behind consumer demand for organics were already in place prior to COVID-19, and are continuing and accentuated, such as interests in foods and beverages with premium, higher quality properties (Figure 2). As we’ve seen for years, organics are also viewed as helping to boost immunity, resilience, general wellness (viewed to be safer for oneself or one’s family) and notably as free from harmful pesticides, chemicals and/or GMOs. Of note, organics are also considered safer for the environment, a topic we are exploring more fully in our 2022 organic update as we explore topics linking organics to sustainability, regenerative agriculture and soil health.

Figure 2: Reasons for Buying Organic Foods & Beverages (Among Organic Purchasers)

Source: Organic and Beyond 2020 report, Te Hartman Group Inc.

What’s Next for Organics?

Organic remains one of the most prominent and significant markers of quality in foods and beverages in the U.S. today. In recent years, we have witnessed the advance of organic products into new categories even as organic foods and beverages become more affordable to the mainstream American consumer.

Going forward, while organics enjoy great popularity, and while many consumers today interpret the organic seal as signaling the epitome of quality, a growing core of more engaged organic consumers are starting to demand more as they look for assurances in farming and production cues that go beyond base organic standards. While health and wellness motivations continue to be central drivers of organic purchasing, connections to sustainability have thus been emerging as another key driver — particularly in terms of forward-looking trends, notably under the rubric of regenerative agriculture and connections to soil health.

More About the New Organic Study:

Organic & Natural 2022, grounded in quantitative and qualitative primary research, offers a comprehensive consumer-centered perspective on the key topics, motivations, tensions, and drivers associated with the organic and natural marketplace both today and in the future. Organic and Natural 2022 will capture the prioritization of specific product attributes, including organic, across over 20 distinct food and beverage categories.

Selected topics include (but are not limited to):

- Evolving consumer understanding of what the terms “organic” and “natural” do and do not mean and how they relate to other claims (such as free-from, non-GMO, local) and to such purchase drivers as quality, health, and sustainability

- Exploration of guarantors of quality, healthfulness, and land stewardship beyond organic (such as regenerative agriculture)

- Consumer priorities and preference for organic vs. other quality and healthfulness cues within specific food and beverage categories and at restaurants

- The where and how of shopping for organic and natural products

Download the Organic and Natural 2022 overview here.

Don’t Miss This Related Upcoming Webinar:

“What’s Driving Consumer Demand for Organic Food and Beverage Products?”

The Hartman Group, in partnership with FoodChain ID, a market-leading provider of technology-enabled food safety, quality, and sustainability solutions, will present a webinar titled “What’s Driving Consumer Demand for Organic Food and Beverage Products?” on February 17, 2022 at 2 pm ET / 11 am PT.

In this informative webinar, The Hartman Group’s CEO Laurie Demeritt will share key insights and implications for CPG brands today based on trend data from The Hartman Group’s latest Organic and Beyond and Sustainability 2021 reports.

Topics will include consumer aspirations, attitudes, and behavior relating to organic food products and highlights of consumer response to third-party certifications and standards that relate to organics, sustainable agriculture (including the topic of regenerative), and GMOs. FoodChain ID will then share insights into efficiently managing third-party certifications, followed by a Q&A.

FoodChain ID is hosting the event and registration is available for free here.