Our newest study Food Sourcing in America 2022 examines the impact of the pandemic (and adjustments made since) in terms of food sourcing as well as emerging consumer considerations due to inflation, supply chain disruptions, and global events.

Inflation is at the highest level in the United States in four decades underscoring a difficult road for all but a lucky few as Americans navigate soaring costs in food, fuel, utilities and many common essential and discretionary household expenses. All of this occurs as consumers attempt to put the pandemic in their rear view mirror and entertain hopeful thoughts about socializing, travel, entertainment and, in general, getting out to try and enjoy summer.

In terms of how such a landscape effects grocery shopping, eating out and food procurement in general, our newest study Food Sourcing in America 2022 builds on over twenty years of Hartman Group shopper research to provide insights on how consumer sentiments and behaviors will impact the food and beverage marketplace both today and in the future.

As an early preview of changes ahead influenced by current inflationary trends, recent Hartman research reveals consumers are aware of changes in a range of prices (e.g., groceries, fuel, housing, utilities, transportation/travel, etc.) and that rising food prices are influencing noticeable changes to grocery shopping habits.

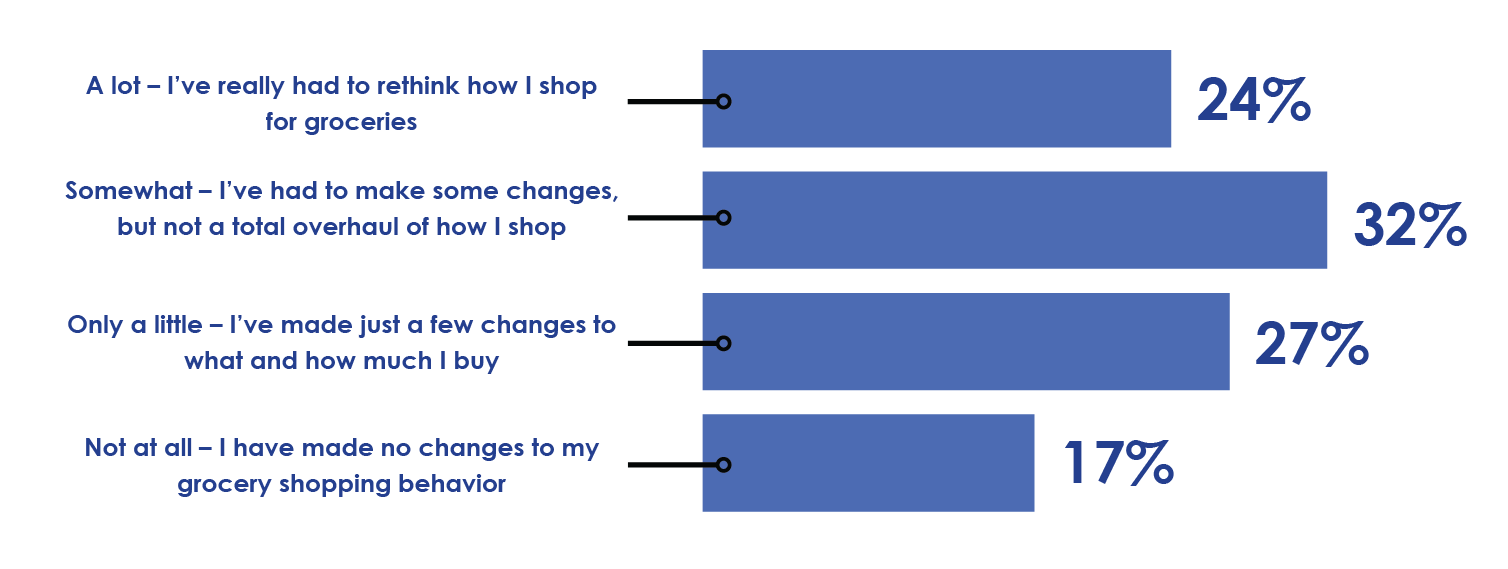

Specifically, we find that when asked how much rising prices have affected their ability to buy foods, beverages and other grocery items that they normally shop for, 24% of consumers who say food prices have risen say such shifts have impacted them “a lot” and that they’ve really had to “rethink how they shop for groceries.” Conversely, 17% of consumers say rising food prices have not impacted them at all and that they’ve made no changes to their grocery shopping behavior (Figure 1).

Figure 1: How Have Rising Prices Impacted Your Ability to Buy Foods, Beverages and Other Grocery Items That You Normally Shop For?

Source: Hartman Group 2022 Survey Research, The Hartman Group, Inc., (click to enlarge)

Among consumers who’ve noted rising prices, those in low (<$35,000) and mid ($35,000 to <$100,000) annual household income tiers report having to make adjustments in how they grocery shop in roughly equal numbers.

Among consumers with household incomes of over $100,000 far fewer have had to make adjustments. Other insights include:

- Women are much more likely than men to report having had to rethink how they grocery shop.

- Baby Boomers are somewhat less likely to report needed adjustments.

Stay-tuned for future previews on how consumers are responding to inflationary headwinds. If you’re interested in learning more, Food Sourcing in America 2022 will update relevant data sets surrounding food shopping and sourcing, as well as explore external factors (like inflation) that are impacting consumers’ food shopping.

The study will provide a comprehensive understanding of shopping behavior at the broad level of landscape and culture, as well as at the level of channel and retailer, including:

- Basic shopping behaviors and habits

- Cultural context and shopping trip dynamics

- Role of online and foodservice in the hybrid shopping environment

- Channel engagement, perceptions, and performance

- Product discovery in the hybrid world

- Budget management while mitigating inflation

|

You can learn more about the Food Sourcing in America 2022 study by downloading the overview and order form here. Special pricing expires June 30, 2022. |